IntraFi® Network DepositsSM

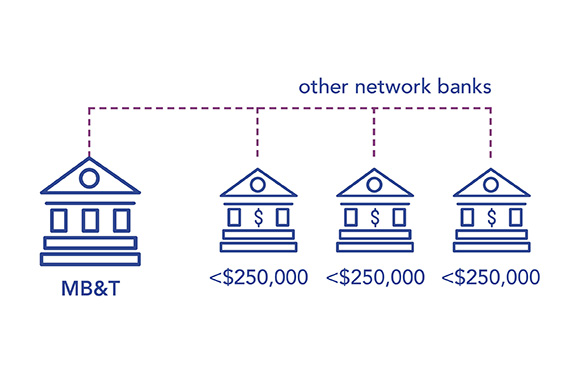

IntraFi Network Deposits is a smart, secure and convenient way to safeguard large deposits placed into demand deposit, money market, or Certificate of Deposit (CD) accounts. With IntraFi Network Deposits you can access multi-million-dollar FDIC insurance and earn interest, all through a single bank relationship with MB&T.